How to overcome the Blue Monday effect on your finances

The holidays are over and many of us can start to feel a bit down. The anticipation of the holidays, and of vacation days, and family is over, and now all we have to look forward to is a couple more months of winter.

It’s common to feel this way after the holidays, and some point to the idea of a ‘Blue Monday’ that hits around the third week of January. This day is considered, by some, to be the most depressing day of the year.

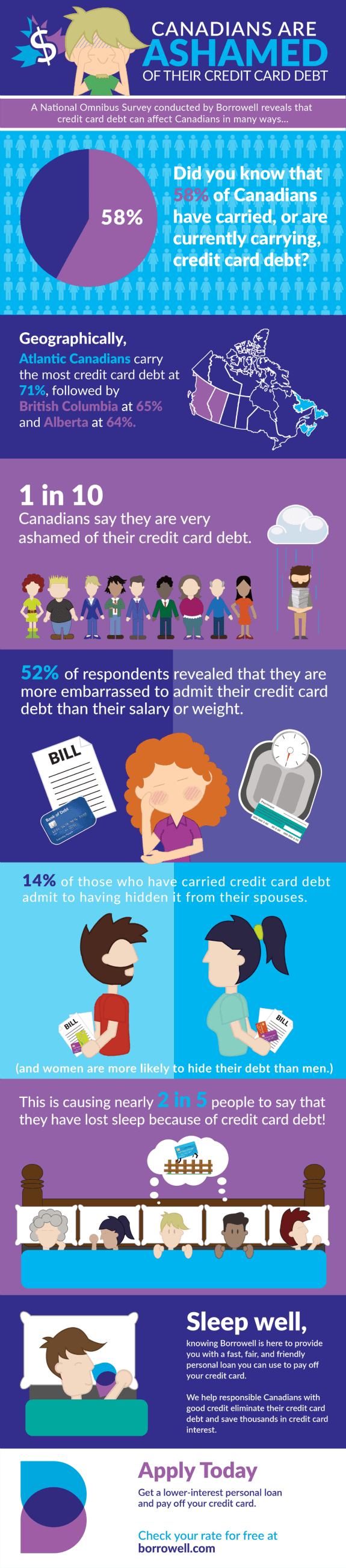

You probably feel the impact as well. The weather is cold, the days are still short, and you might be just seeing your credit card bills from your holiday expenses. A recent survey from Borrowell indicates that 58% of Canadians currently carry (or have carried) credit card debt. The holiday season tends to encourage debt spending, and it’s no surprise that the disappointment of facing up to the bills weighs on many of us after the holidays are well and truly over.

If you are starting to feel the Blue Monday impact, you can overcome it. Here are the six factors that contribute to making this the most depressing day of the year — and what you can do to overcome the financial realities of Blue Monday.

1. Weather

The weather is cold this time of year. The snow seems charming when it first falls, and we all love a white Christmas. But once we get most of the way through January, it doesn’t seem as attractive. Plus, there are costs involved when it comes time to keep your car running. You use extra electricity to plug in the engine heater, and your home uses more energy to keep warm.

If you want to cut down on the costs related to the weather, take good care of your home. Good home maintenance is key to preventing many weather-related problems, such as ice dams building up and causing damage. Another tip for saving money is performing a home energy audit. Find out where your heat leaks are and plug them up. You can’t change the weather, but you can reduce how expensive it is for you.

2. Debt

There are few things in life that can bring you down as much as debt. When it comes to Blue Monday, a lot of the debt involved is from the holidays. You don’t think about it much while you’re in the moment, but this is the time when the bills start arriving. Once you see the credit card bill, it’s a different story — and that can be disappointing.

One of the best things you can do to improve your mood is to make a plan to pay off your debt faster. Take a look at your situation, and create a plan to tackle your debts in turn. Just having a plan, and moving forward, can help you feel better.

3. The holidays are over

From about the first of September until just after the New Year, many of us feel a bit of a rush. It’s the holiday season. School is back in for the kids, you have Halloween, Thanksgiving, Hannukkah, Christmas, and New Year. There’s a lot going on and a lot to look forward to. Blue Monday is difficult because you are in the post-holiday letdown.

You can turn this around, however. Even though you have to go back to work, the fact that you got some downtime to recharge and enjoy a holiday means that you have the chance to be more productive. This is a good time to show your marketable skills, throw yourself into the work, and increase your earning power.

4. Broken financial resolutions

We all like to set goals for the new year. However, by the time Blue Monday rolls around, many of us are disappointed in ourselves. There’s a good chance that you’ve already failed in at least one of your resolutions. The key to getting beyond the broken financial resolutions you might already have is to treat it like a work in progress. Just because you didn’t stick to your goal perfectly every day this year doesn’t mean that you have to give. Take a look at the progress you have already made, break down your goals into manageable steps, and start again tomorrow. You can always work to improve your finances, no matter the time of year.

5. Low motivation levels

There’s a lot going on that can reduce your motivation during this time of year. Short days can lead to Seasonal Affective Disorder, and you might be struggling to move forward. This is the time to look for positivity in your life and your finances. It can be difficult, but looking around and expressing gratitude for what you do have, as well as recognizing that you can take that step forward, can help you get out of your funk.

The first step to more positive finances is to look for one way that you can take action right now. It might be signing up for a class that will help you gain certification to help you in your career. It could be researching ideas for a side hustle. Maybe it’s making one extra debt payment to kickstart your plan. No matter what it is, take that first step to feel a little more positive. Once you start going, you’ll feel your motivation level rise a little bit.

6. Feel overwhelmed

It’s easy to feel overwhelmed when you look at your finances and your life. At the very start of the year, you might feel fresh, but by the time Blue Monday gets here, you’re starting to feel overwhelmed. The important thing is to take action. It doesn’t have to be a big action, either.

This is a great time to start a new investing plan, contribute a little more to your RRSP or TFSA, or create your debt reduction plan. When you feel overwhelmed, take a step back and then look at one small thing you can do to move forward. You might be surprised to discover that it’s possible to overcome your feelings of disappointment and difficulty when you break your financial goals down and focus on one small thing at a time.

Comments

So true. Great article Tom. Very inspiring:)

Comfortimg to know that January is a tough month for most of us.